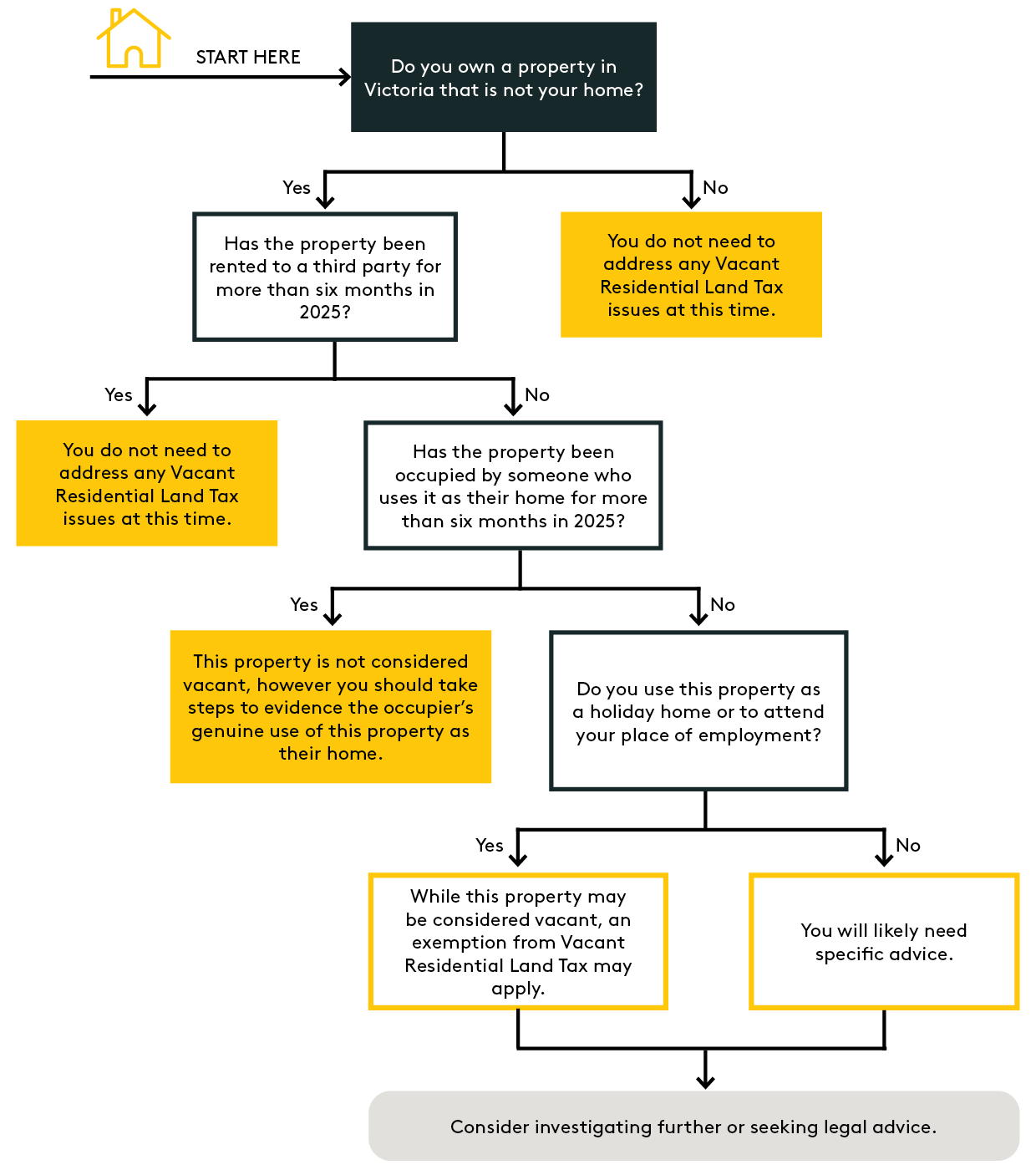

The laws governing Vacant Residential Land Tax (VRLT) in Victoria have changed, and now potentially apply to all properties across Victoria. Broadly, VRLT applies where any Victorian residential property remains vacant for six months or more, commencing from the 2025 calendar year.

What does vacant mean?

A property can still be considered vacant even when you or family use it sometimes during the year. While there are some limited exemptions, the law is not straightforward, and the use of a company or trust to hold property complicates the issue further.

Common exemptions may include:

- Holiday homes for personal use

There are technical requirements for use of the property by the owner and/or the owners’ relatives. These requirements become more involved if the holiday home is owned via a company or trust structure, and not all holiday homes in these structures will be eligible for exemption.

- Property (other than the owner’s home) occupied to attend their workplace

The eligibility requirements for this exemption are complex. It is important to understand the detail and how this may apply to you.

Importantly, properties that are passed to a trust structure in your Will will not be eligible for exemption.

Use this flowchart to see whether the VRLT laws will apply to you, and whether you have a notification obligation.

Page updated January 2026

To discuss your specific situation or for assistance with lodging a notification or claiming an exemption, complete our contact form.